Our Opinion: 2014

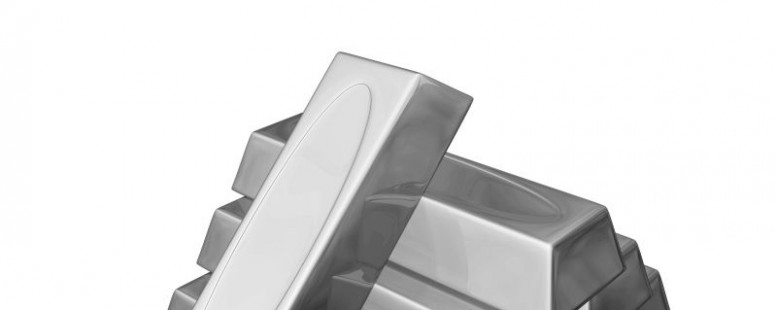

A boost for gold

The gold price has bounced by 5% this month, as the markets have suffered a scare over global growth prospects. The $1,200 lower support level had been challenged, but not breached, for the second time this year. The jitters spurred the biggest rush into US gold securities since July, forcing prices well above the $1,200 mark. This was helped by falling real interest rates (allowing for inflation) and falling bond yields. The higher real interest rates are, the less appealing gold is since it offers no yield. Prices have also been buoyed by solid demand for gold bars and jewellery in Asia, notably in the run up to the Diwali festival.

What next? The US recovery remains on track, suggesting higher interest rates. However, interest rates are unlikely to increase quickly or significantly. Monetary loosening is happening in Japan and Europe and all the money printing could well lead to a surge in inflation in the next few years. Meanwhile, as emerging Asian consumers and investors get richer, their demand for gold should climb, while emerging market central banks have also been increasing their gold purchases in recent years.

There is, therefore, scope for further gains. Capital Economics see gold reaching $1,300 next year and $1,400 in 2016.