Technical News: Issue 8

HMRC guidance on new non-dom rules

As had been awaited, HMRC have published guidance on the new rules for individuals who are non-UK domiciled and offshore trusts which took effect from 6 April 2017 and were legislated in the Finance (No.2) Act 2017. Non-UK domiciled individuals will need to make sure they are ready for these changes.

Residence, Domicile and Remittance Basis Guidance (RDR1) becomes essential reading for international clients, or their advisers, spending time in the UK.

Amongst the highlights are the revised guidelines to cleansing of mixed funds. A high-level summary has been published, with examples of these transitional rules which allow a window up until 5 April 2019 to enable division of the income, capital gains, and ‘clean’ capital elements of existing non-UK bank accounts into separate accounts. If managed correctly, this would enable any non-domicile who has previously been taxed on the remittance basis prior to 2017/18, to remit to the UK without a tax charge ‘clean’ capital from overseas which was previously trapped within a mixed fund.

These is also a new short high-level summary explaining the deemed domicile rules, and confirmation of Remittance Basis Changes, explaining that individuals who become deemed domiciled will no longer be able to use the remittance basis and will be taxed on worldwide income and gains.

There is also new guidance for trust protections and capital gains tax changes, which takes the form of a detailed 54 page document, which primarily covers the new rules for offshore trusts. This includes income tax and capital gains tax ‘protections’ for offshore trusts; transfer of assets abroad legislation trust protections; how trust protections can be lost through tainting and the valuation of benefits received from offshore trusts. In addition, this guidance also covers the transitional rules enabling individuals becoming deemed domiciled in April 2017 to be able to benefit from rebasing of certain foreign assets to their market value on 5 April 2017. It also covers the changes to the rules for temporary non-residents, foreign loss elections and carried interest gains.

At the moment the documents published do not include provisions which extend the UK Inheritance Tax net to all residential properties in the UK that are owned by non-doms, whether directly or through a company or trust structure. These changes will also include those who lend money, or provide security, to purchase UK residential property.

2018 changes to UK Visa requirements

From 11 January 2018, a number of changes took effect with regard to the UK’s Immigration Rules. The good news is that requirements for a Tier 1 Investor Visa remain largely untouched. Investors, who applied for a visa before 6th of November 2014, will be able to rely on funds of the un-mortgaged private property, which is the applicant’s main home. In case the property is co-owned, the investor can rely only on his or her share.

With regard the Tier 1 Entrepreneur visa the rules have not in themselves changed, however the new guidance clarifies and expands the previous wording. For example, the new wording seeks to prevent the ‘recycling’ of funds. Applicants cannot rely on funds or investments that have been provided by another Tier 1 (Entrepreneur) visa holder or his close family members. The question “who can be considered as close family member” will be considered individually. There is further detail on the requirements of any documentary evidence that is provided. The rules concerning creation of jobs for domestic workers have been clarified.

It is worth noting that in support of the changes announced in the Autumn Budget 2017, the number of Tier 1 Exceptional Talent visas allocated annually is being doubled to 2,000. Of these the additional 1,000 visas will be held separately, in an unallocated pool draw on a first-come, first served basis.

Exceptional talent visa holders (but not exceptional promise visa holders) are also now permitted to qualify for Indefinite Leave to Remain after three years.

Importantly, changes to individuals’ rights to the Leave to Remain should be noted. The requirement to have had absences from the UK of no more than 180 days per year in order to qualify for settlement, which currently applies to main applicants is being extended to partners of Points-Based System Migrants (this will include partners of Tier 1 (Investor), Tier 2 (Entrepreneur) and Tier 2 (General) and (Intra-Company Transfer) migrants. However, absences from the UK during periods of leave made before 11 January 2018 will not count towards the 180 days.

Therefore, the dependant of the main visa applicant will now need to stay in the UK more than 185 days per year to achieve Indefinite Leave to Remain. This may have an impact on the 2018 Tier 1 Investor Visa applications.

As always, we recommend that you make yourself familiar with any changes to the UK Tier 1 visa system.

Rise in Tier 1 (Investor) Visa applications

From early 2015 through to 2016, since the minimum investment required for the Tier 1 (Investor) scheme was raised from £1 million to £2 million in November 2014, the number of UK Investor Visa applications dropped significantly. It was clear that the decision to raise the minimum investment caused some HNWs and UHNWs to decide against coming to the UK. Others instead chose to apply for the Entrepreneur Visa, which only has a minimum investment requirement of £200,000; an option that has gained popularity over the past few years.

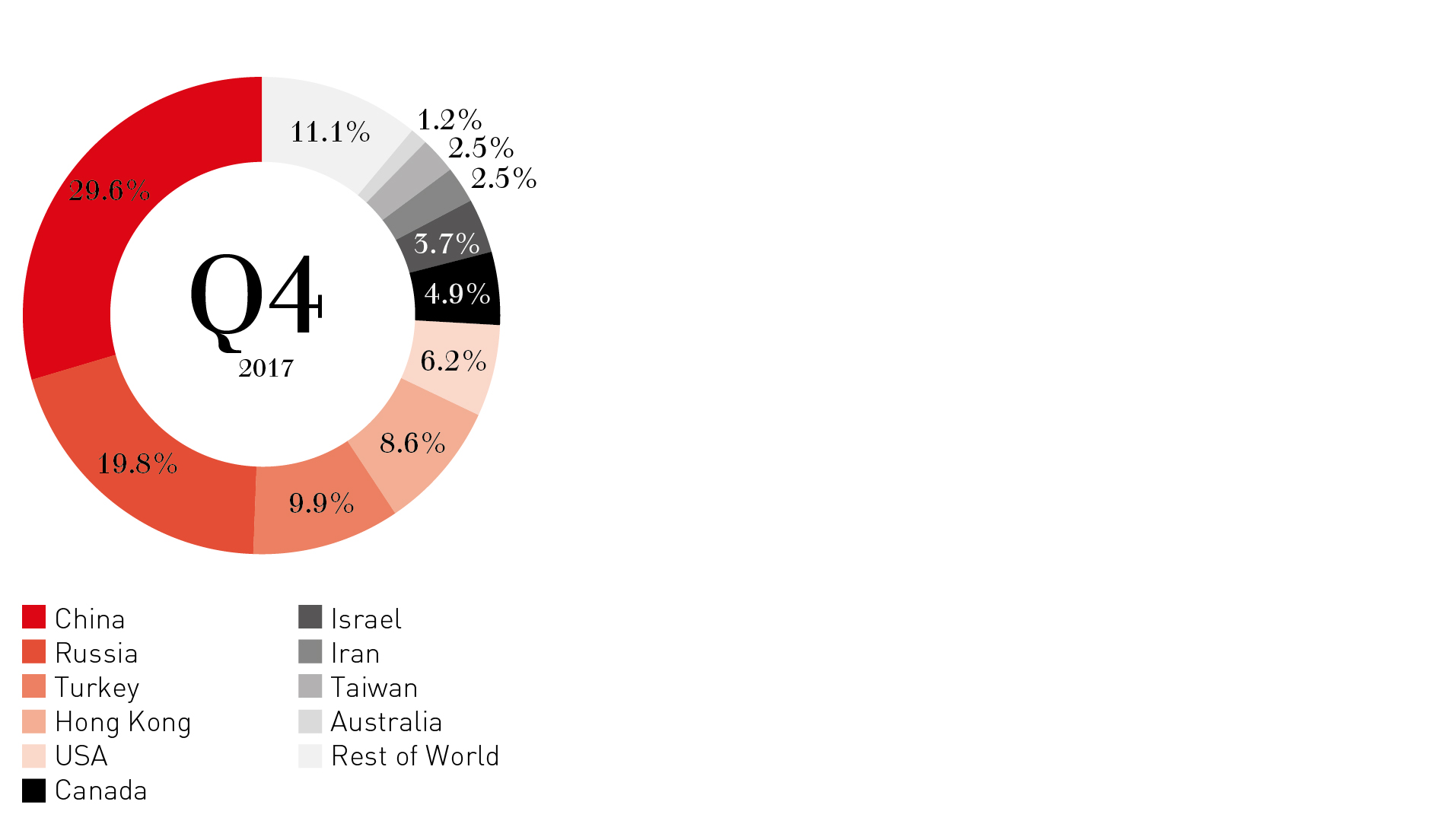

However, the Home Office recently released statistics for the last quarter in 2017, showing that the number of Tier 1 (Investor) visa applications is now on the rise. In Q4 2017 there were 81 visas granted, bringing the total to 355 visas granted for the year. This is a 160% increase compared to the 2016 total of 217 visa applications, suggesting that the applicants are looking to both invest and settle in the UK.

Four tricks to beat buy-to-let tax rises

We have recently reported, in both Update and Technical News, the crippling tax rises affecting Buy-to-Let properties in the UK, but London in particular. Property investment has been, and remains, a favourite asset class for many international clients.

But those investors committed to the market will need to find ingenious ways to fight back, to protect their investments.

The series of punitive reforms began with the stamp duty surcharge and culminated last year in much tighter lending restrictions. But the real hammer blow is the removal of mortgage interest tax relief.

From April 2018 only 50% of mortgage interest payments will be deductible as a business expense. By 2020, the option will be removed entirely for higher earners. The NLA (National Landlords Association) estimates some landlords could pay double the tax of an employee with the same earnings.

In 2020, tax relief on mortgage interest will be replaced by a 20% tax credit, leaving basic-rate taxpayers largely unaffected. So, reducing income below the higher-rate threshold could drastically lessen the impact.

How the buy-to-let tax changes take affect

Example

Your client pays 40% income

tax and has a buy-to-let property earning £20,000 a year, and

an interest-only mortgage costing £13,000.

Currently

Tax is due only on the profit (ie £7,000) meaning a £2,800 tax bill and £4,200 for your client.

From 2020

Tax is due on full rental income of £20,000, less a tax credit equal to basic-rate tax on the interest.

Your client pays 40% tax on £20,000 (£8,000) less the 20% credit (20% of £13,000 is £2,600).

HMRC gets £5,400 and your client gets £1,600, meaning a 93% increase in his tax bill.

An option is to incorporate the investment into a company structure. Your client will pay 20% corporation tax on the profit, so HMRC gets £1,400

and your client will get £5,600.

1. Change the mortgage

Married landlords will be able to mitigate their tax liability by structuring their borrowing correctly. A landlord who is a higher-rate (40%) taxpayer and who is married to someone paying the basic rate of 20% or no tax at all could transfer the majority of the mortgage payments to their spouse.

If the property is currently owned by the higher-rate taxpayer, they should set up ownership so they are ‘tenants in common’.

This would allow them to set up the mortgage so the basic-rate taxpayer made 99% of the payments, meaning 99% of the cost would be transferred to the spouse, allowing them to make use of both personal allowances and reduce their tax bill. The lower-rate taxpayer would be less affected by the changing rules, because of the 20% tax credit.

Investors need, of course, to consider the legal costs involved in changing

the deeds.

2. Pay into a pension to pay less tax

International clients who are resident in the UK, and have taxable income here, can earn as much as £85,000 a year and still pay tax at the basic rate.

The secret is saving into a pension, which reduces salary for tax purposes. Savers can put up to £40,000 a year into their pots, meaning they can prevent themselves exceeding the £45,000 higher-rate threshold.

The attractive incentives available on pension saving mean the Government effectively boosts contributions through tax relief which, combined with the 20% tax credit, would counteract the effect of the policy. Of course, the downside is take-home pay would immediately fall, and the money would be locked away until age 55.

This technique is open only to landlords who also have earnings aside from their property. Rental income does not count as ‘pensionable earnings’, capping a full-time landlord’s contributions at £3,600 a year.

3. Structure your investments

Investing in some tax-efficient assets could also help landlords trying to offset the changes.

All investments generating an income should be held within an ISA to lower income tax liabilities. International clients rarely make use of this allowance, which is available to all UK residents, regardless of their nationality.

Investing in Venture Capital Trusts (VCTs) and the government-backed Enterprise Investment Scheme (EIS) both qualify for tax relief at 30% as long as certain conditions are met.

4. Give to charity

Altruistic landlords could use charitable donations to reduce their exposure to tax at the higher rate.

While charities can claim gift aid on your donation, donors who pay tax at 40% can personally claim the difference between the rate they pay and basic rate on their donations. This means a 40% taxpayer who donates £100 could potentially claim back £25.

It has never been more important for UK investors who are non-domciled to take advice on their tax structures – particularly relating to property. We work with a number of specialist advisers to ensure international clients benefit from the highest standards of advice and service.

Agreement on path to Brexit

With a year to go before the UK leaves the EU, an agreement has been reached on a transition deal with the EU27 covering the 18 months after Brexit, positive news for the UK economy and particularly the Pound.

The announcement has been welcomed by politicians on both sides, as well as the currency markets. The terms of the transition deal contain few surprises.

Economically, little should change for the UK, as it will remain a full participant in the single market and customs union, abide by EU rules, and continue to make payments into the EU budget.

Politically, much will change as the UK will no longer have representation at the main EU bodies that set the rules for the single market. The agreement on the transition deal lessens the downside risks to the UK economy in the short term, as it should reduce the need for companies in the UK to make immediate adjustments to their operations. If the economy continues to press ahead at its current rate (growth around 0.4% quarter-on-quarter), it is likely that the Bank of England will hike rates when it convenes for its policy-setting meeting in May, and Sterling is likely to build on its recent strength.

Despite the negative reaction from the Brexiteers in the Conservative Party, there is little effort to scupper the deal, since they have their eyes on the bigger prize. Protesting about fishing rights is one thing, but leaving the EU remains the goal, and it is already notable how quiet the hardliners have been compared to how we think they could have reacted.

But one question remains unanswered that could eventually derail the talks: Northern Ireland. The so-called ‘fallback option’ demanded by the EU27 still seems an unacceptable position for the Prime Minister, as it would essentially mean splitting up the UK single market. The current political arithmetic, which leaves the Conservatives reliant on the Democratic Unionist Party for their majority in parliament, muddies the waters further.

It is still difficult to see how the Northern Ireland question can be solved without knowing what the future trade and customs arrangements between the UK and the EU will be, and the full picture is unlikely to be known until the end of the transition phase at the earliest. Nevertheless, a compromise solution is likely to be found, needing some imagination and compromise on both sides – something that the EU27 has been unwilling to show in the negotiations so far.

Agreement on the transition period opens up the next phase in the negotiations, which are discussions on the future trade relationship. There is still the possibility that the final agreement could be rejected by UK politicians, or the EU for that matter and, as underlined by both sides, “nothing is agreed until everything is agreed.”

As the year progresses, there seems a high probability that uncertainty will return around the time Parliament meets to ratify the exit agreement (most likely around October). It is also likely to remain high during the transition period as the UK and the EU27 try to flesh out the new long-term trade relationships. The 21-month window that is provided by the transition period looks extremely ambitious given how long it usually takes the EU to negotiate trade deals. This will keep alive the prospect of a ‘cliff edge’ moment for the UK come the end of 2020. This makes it unlikely that we will see a surge in business investment, boosting growth, anytime soon. Nevertheless, if current levels are maintained, the economy should remain on a steady path.

There is positive news from other sources. Global growth is set to remain decent, which should support UK exporters, and the UK labour market continues to show strength. In addition, the peak of inflation seems to have passed, which is another factor that should further support the Pound in

the months ahead.